tax shield formula for depreciation

However the straight-line depreciation method the depreciation shield is lower. It is calculated.

Tax Shield Formula Step By Step Calculation With Examples

The gradual reduction of an assets valueIt is an expense but because it is non-cash it is often effectively a tax write-off.

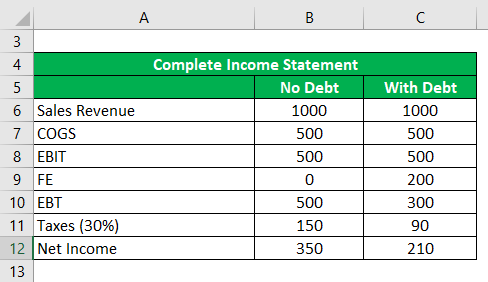

. This is derived from 25000 in rental income minus 18182 in depreciation expense. The effect of a tax shield can be determined using a formula. EBITDA Net Income Tax Expense Interest Expense Depreciation Amortization Expense 19 19 2 12 52.

Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. Depreciation Tax Shield Formula. That is why we dont have that line CCA tax shield anymore.

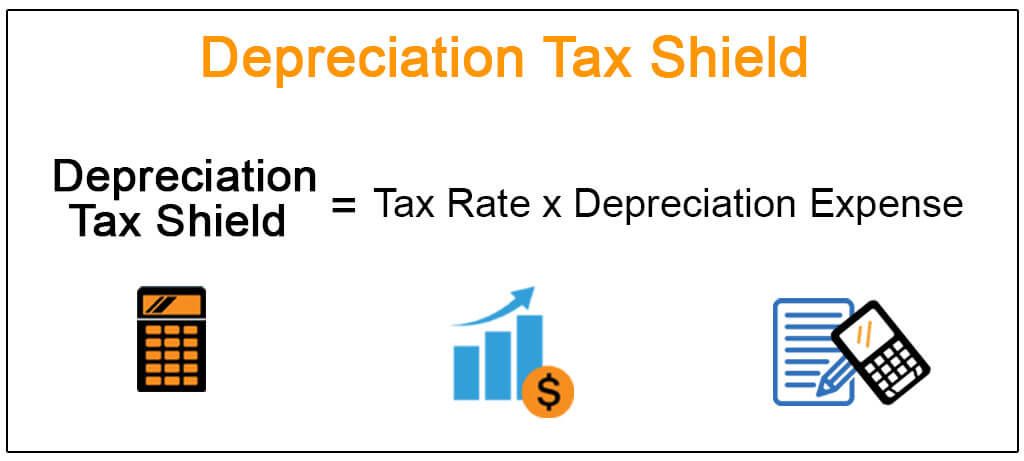

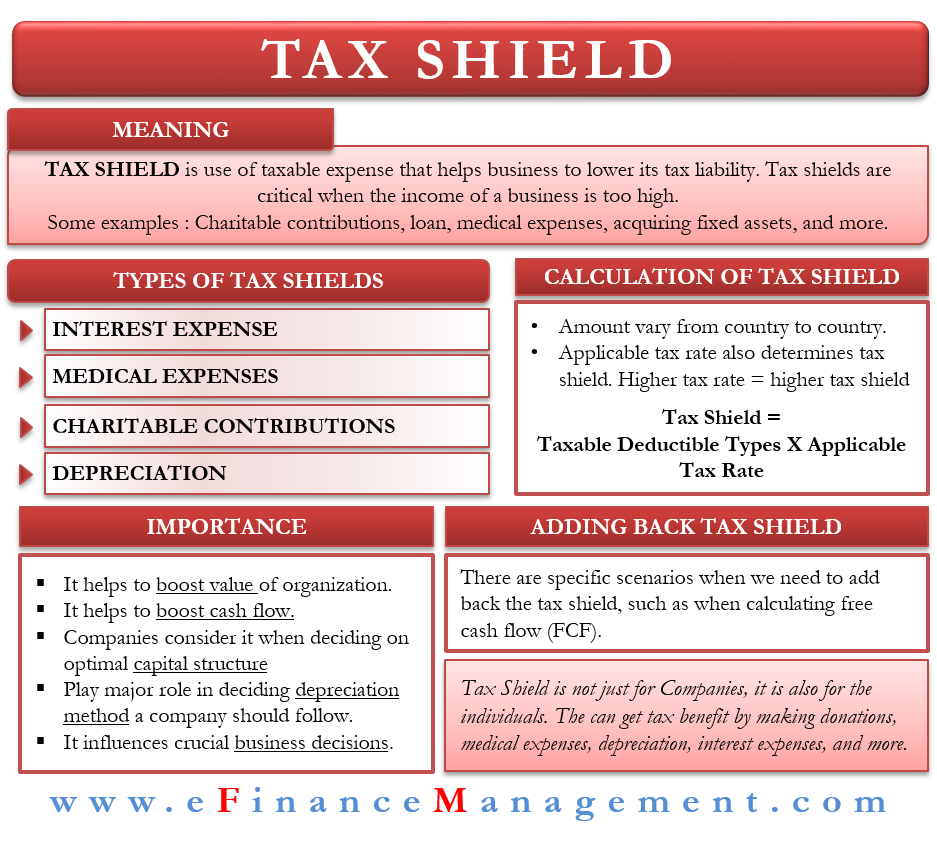

For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Companies using accelerated depreciation methods higher. Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax shield.

It is calculated by multiplying the tax rate with the depreciation expense. Next determine the assets residual value which is the expected value of. Assuming the same tax rate of 25 you would only have to pay 1705 in taxes.

Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income. Depreciation Tax Shield Example. All you get from CCA tax shields are the four numbers for each year under CCAT.

Calculate Earning Before Interest Taxes Depreciation and Amortization. Depreciation Expense Remaining Useful Life. That is a person or company usually may reduce hisherits taxable income by the amount of the depreciation on the asset.

Depreciation tax shield Tax Rate x Depreciation Expense. A depreciation tax shield Depreciation Tax Shield The Depreciation Tax Shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. The formula for depreciation under the straight-line method can be derived by using the following steps.

Cash Flow After Taxes - CFAT. To increase cash flows and to further increase the value of a business tax shields are used. EBITDA Revenue Cost of Goods Sold Operating Expenses Depreciation Amortization Expense 82 23 19 12 52.

Compared to 6250 thats about 4500 saved in taxes. Formula Method C Depreciation schedule half year rule Year CCA UCC 0 120000 1 12000 108000 2 21600 86400 3 17280 69120. It and can be calculated by multiplying the tax rate with the depreciation expense.

Firstly determine the value of the fixed asset which is its purchase price. 4800 8640 6912 and 5530. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below.

Cash flow after taxes CFAT is a measure of financial performance that looks at the companys ability to generate cash flow through its operations. A tax form distributed by the Internal Revenue Service IRS and used to claim deductions for the depreciation or amortization of a piece of property or. Tax Shield Formula.

So as you can see real estate depreciation acts as a tax shield and reduces your taxable income. Read more is a tax reduction technique under which depreciation expenses are subtracted from. In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption.

Because there are many different ways to account depreciation it often bears only a rough resemblance to the assets useful life.

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Calculator Calculator Academy

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Docsity

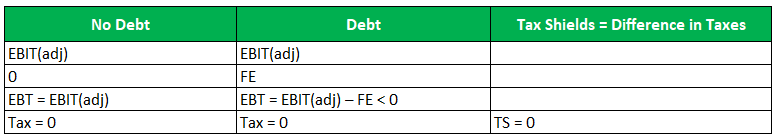

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example

What Is Depreciation Of Assets And How Does It Impact Accounting

Depreciation Tax Shield Formula And Excel Calculator

What Is A Tax Shield Depreciation Tax Shield Youtube

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube